It does not seem to be happening but it is coming.

A friend sends me the following interview. http://www.thedailybell.com/29047/Anthony-Wile-Antal-Fekete-Gold-Backwardation-and-the-Collapse-of-the-Tacoma-Bridge. It is

difficult to listen but it points to the end point to which all these craziness

happening in the world today. There are plenty of books and websites describing

similar scenarios. The more balanced views are those by Jim Rickard “Currency Wars”,

Mauldin “End Game" Niall Fergusion "The Ascent of Money". There are the more extreme

views by like Prechter and Peter Schiff.

While I dismiss many of the Armageddon forecasts, I cannot deny that we

will somehow end this modern experiment of Keynesian economics quite badly.

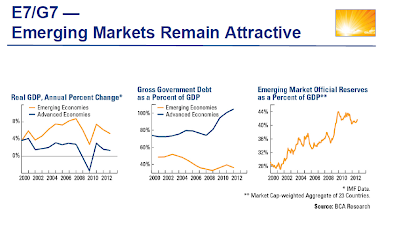

Technically, UK, France, Spain, Portugal Japan are bankrupt.

Japan has reached 250% of debt to GDP

US is the biggest debtor in the world. It debt has gone from

$800 billion when Obama took over to $3.2 T now. The balance sheet is growing

exponentially.

Fed is buying ¾ of the Treasuries issuances now. It is a

matter of time, they will be buy 100%.

Since 2008, there is an injection of $20T into the market

globally. Wonder why the market having a great time in an environment of anemic

economic growth?

Total world debt is $250 Trillion excluding unfunded liabilities.

Out of this amount, there is easily a 10% bad debt which is around $25 T. The actual bad debt is most probably 33%

which is around $70T. This is the same amount as the total world’s GDP. Add to

this are one quadrillion of global derivatives accumulated during the 2008

crisis. Most of it is worthless now.

From March 2009 when the

first round of quantitative easing began, central banks have cut interest rates

a total of 515 times and injected $12 trillion into markets.

Keynesian economists point to the “escape velocity” needed to

get us out of the poor economic environment. We will really need rocket fuel to

get us out of these debts. All these scholarly discourse does not tell us how

the debt will be repaid!

It is still partying time in the market. When this party

will end, it is hard to conjecture. With all the manipulation and coordinated

pumping of liquidity, the party can continue for a while. But it will end

badly.

One cannot be too pessimistic short term or you will lose the intermediate gains which can be huge. If you follow the doom day scenario after the dot.com bubble around 2001 and housing crash on 2008, you would have lost huge opportunity to make money on the rebound.

But it will end. When it ends, a number of things should happen.

First, there will be a return to value which means assets

which retains the value will go up in prices. A reset of the financial system

will occur ending the experiment.

Second, there will be inflation or maybe hyperinflation.

Third, there will be a collapse of major currencies.

Finally, there will be massive bond and treasuries collapse

ending the 30 years bond bubble. The price actions on the last few days points

to bond prices breaking down. We should know by next week whether this is

happening.

This is the black swan that will one day appear. It is not a

question of whether it will be appearing but when.

These are all facts not some dreams, illusion or scholarly

theories or formulae. These are empirical data and not theoretical assumptions

of economics.

I shudder to think of what could happen.