Greenspan actually said this in 1960! He did not practice what he believed. It remains true today.

"Under a gold standard, the amount of credit that an

economy can support is determined by the economy's tangible assets,

since every credit instrument is ultimately a claim on some tangible

asset. But government bonds are not backed by tangible wealth, only by

the government's promise to pay out of future tax revenues, and cannot

easily be absorbed by the financial markets. A large volume of new

government bonds can be sold to the public only at progressively higher

interest rates. Thus, government deficit spending under a gold standard

is severely limited. The abandonment of the gold standard made it

possible for the welfare statists to use the banking system as a means

to an unlimited expansion of credit. They have created paper reserves in

the form of government bonds which - through a complex series of steps -

the banks accept in place of tangible assets and treat as if they were

an actual deposit, i.e., as the equivalent of what was formerly a

deposit of gold. The holder of a government bond or of a bank deposit

created by paper reserves believes that he has a valid claim on a real

asset. But the fact is that there are now more claims outstanding than

real assets. The law of supply and demand is not to be conned. As the

supply of money (of claims) increases relative to the supply of tangible

assets in the economy, prices must eventually rise. Thus the earnings

saved by the productive members of the society lose value in terms of

goods. When the economy's books are finally balanced, one finds that

this loss of value represents the goods purchased by the government for

welfare or other purposes with the money proceeds of the government

bonds financed by bank credit expansion.

In the absence of the gold standard, there is no way to

protect savings from confiscation through inflation. There is no safe

store of value. If there were, the government would have to make its

illegal, as was done in the case of gold (in the 1930s). If everyone

decided, for example, to convert all of his bank deposits to silver or

copper or any other good, and thereafter declined to accept checks as

payments for goods, bank deposits would lose their purchasing power and

government-created bank credit would be worthless as a claim on goods.

Therefore, the financial policy of the welfare state requires that there

be no way for the owners of wealth to protect themselves.

This is the shabby secret of the welfare statists'

tirades against gold. Deficit spending is simply a scheme for the

confiscation of wealth. Gold stands in the way of this insidious

process. It stands as a protector of property rights. If one grasps

this, one has no difficulty in understanding the statists' antagonism

toward the gold standard."

Wednesday, May 23, 2012

Thursday, May 3, 2012

Gold and Silver - Up or Down?

For

those who are invested in gold and silver, you have a bad time! I am in the

group although I am suffering less because of my ability to hedge.

The

reality is, for a bubble to occur, you need a number of ingredients that we

just don’t have yet. You need prices that are inflated way beyond an asset’s

underlying value, which is not the case with gold — based on its role as a

counterweight to overprinted fiat currencies worldwide, I’d argue it’s still

very undervalued.

The

reality is, for a bubble to occur, you need a number of ingredients that we

just don’t have yet. You need prices that are inflated way beyond an asset’s

underlying value, which is not the case with gold — based on its role as a

counterweight to overprinted fiat currencies worldwide, I’d argue it’s still

very undervalued.

I maintain that gold is still in a super bull

cycle supported by fundamentals. Short term the price can still go down but the

longer term trend remains.

And, you need a sense that absolutely everyone around you is piled into the asset. Right now, that’s not the case, with less than 1 percent of total global financial assets in gold. Contrast that to CPM Group’s figures from 1968, when gold held by individuals for investment purposes was 5 percent; that was 3 percent by 1980; and by 2000, it was only 0.2 percent.

So gold ownership has grown about 0.6 percent since 2000, despite the dramatic rise in bullion’s price from its sub-$300 level back then.

In terms of valuation, mining stocks are now valued at around $1000 gold. Sentiments is at same level as 2008.

HUI which is the index for measuring gold stock is at 2001 level - a decade ago when it is calculated on a ratio to gold.Technically, it needs to show some support or it will move to a final wash out at 350. At 415 - which is today's level, it is exactly 50% from the retracement since QE 1 was announced back in 2008.

HUI which is the index for measuring gold stock is at 2001 level - a decade ago when it is calculated on a ratio to gold.Technically, it needs to show some support or it will move to a final wash out at 350. At 415 - which is today's level, it is exactly 50% from the retracement since QE 1 was announced back in 2008.

Any intelligent thinking person will know that most of the above is not true.

Gold

and Silver has gone down for almost a year. Gold mining and junior stocks are

massacred.

The

question now is whether Gold and silver is in a bubble and on a long term

downtrend.

The

reality is, for a bubble to occur, you need a number of ingredients that we

just don’t have yet. You need prices that are inflated way beyond an asset’s

underlying value, which is not the case with gold — based on its role as a

counterweight to overprinted fiat currencies worldwide, I’d argue it’s still

very undervalued.

The

reality is, for a bubble to occur, you need a number of ingredients that we

just don’t have yet. You need prices that are inflated way beyond an asset’s

underlying value, which is not the case with gold — based on its role as a

counterweight to overprinted fiat currencies worldwide, I’d argue it’s still

very undervalued.And, you need a sense that absolutely everyone around you is piled into the asset. Right now, that’s not the case, with less than 1 percent of total global financial assets in gold. Contrast that to CPM Group’s figures from 1968, when gold held by individuals for investment purposes was 5 percent; that was 3 percent by 1980; and by 2000, it was only 0.2 percent.

So gold ownership has grown about 0.6 percent since 2000, despite the dramatic rise in bullion’s price from its sub-$300 level back then.

In terms of valuation, mining stocks are now valued at around $1000 gold. Sentiments is at same level as 2008.

HUI which is the index for measuring gold stock is at 2001 level - a decade ago when it is calculated on a ratio to gold.Technically, it needs to show some support or it will move to a final wash out at 350. At 415 - which is today's level, it is exactly 50% from the retracement since QE 1 was announced back in 2008.

HUI which is the index for measuring gold stock is at 2001 level - a decade ago when it is calculated on a ratio to gold.Technically, it needs to show some support or it will move to a final wash out at 350. At 415 - which is today's level, it is exactly 50% from the retracement since QE 1 was announced back in 2008.

I

am not able to predict the short term trend. Technically, it appears weak and

may still go down.

When

the market is at such a overwhelming negative sentiment and the fundamentals

are fully supportive, it is time to “buy when there is fear and sell when there

is greed”. A contrarian strategy usually works very well. Price especially

mining companies has been cheapest in decade - never has

the fundamentals and price gap so wide. In 1-2 years time, you will probably

look back and wonder why you have not bought it at such a cheap price. Bigmoney are made when you are able to catch such bottoms. On the other hand,

catching the bottom is like catching a falling knife. So a good risk protection

strategy is paramount.

The

downtrend can continue for a while. This is where a collared strategies work in

such market.

Longer

term, the I like to simply give just 2 primary reasons that support the long

term bullish trend of gold and silver.

1.

Money Printing.

The

world continues to print money and is going berserk.

There

is no way that the debt incurred can be paid.

There is no way the debt incurred can be paid.

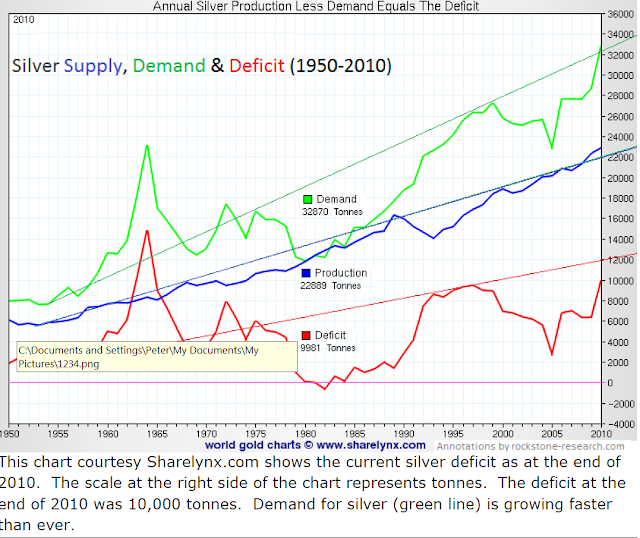

There is an accelerated accumulation of physical metals. One day the physical shortage will be acute and that will be the "D" day for the battlefield.

There are overwhelming reasons to be long term bullish for the metal. The contrary views will be as following:

· The global gold market is free, fair and honest. The smack down of 7500 contracts in 1 minute, 10,000 contracts in 5 minutes and various incidents at precisely the same time, all before critical news on gold such as Swiss Franc pegged to Euro, news of LTRO, gold almost crossing critical point at 1780 were all coincidence. These are free market in actions.

· The Comex futures market is a true, fair and perfect price discovery vehicle.

· There is no demand for physical gold and/or silver in size. All of this talk about sovereign nation and central bank buying is simply a tool used to manipulate price higher. It is coincident that just in March, 12 more central banks bought sizeable amount of gold.

· The Federal Reserve never has, and never will, intervene in gold to manipulate and suppress price. They exists to ensure job growth, currency stability and economic prosperity and they are doing a fantastic jobs. From Greenspan to Bernanke, they have saved the world from a world war II depression.The Federal Reserve never has, and never will, intervene in the equity, treasury and/or currency markets

· The bullion banks simply engage in selling forward for their mining clients.

· Gold really is a barbarous relic of another time despite it being used as money for thousands of years.

· Fiat currency is wonderful because limitless money creation spreads wealth globally. Money are created from nowhere.

· The Chinese are fools who mindlessly continue to accumulate dollars with no alternative but to reinvest those dollars into U.S. treasuries.Same for the Russians.And the Saudis.And the Japanese.

· Paul Krugman is a genius.So is Nouriel Roubini.

· The total debt level of the U.S. is manageable and not a problem, at all. We will pay off all the debts soon with our economic prosperity and productivity Economic growth will soon return the U.S. to peace and prosperity while allowing for the service of the accumulated national debt.

· Barack Obama is the most intelligent and supremely qualified Chief Executive that the United States has ever had.

· TARP was extraordinarily successful and actually turned a profit for the American people. The occupied war street movement are just a bunch of losers.

· Deficits don't matter. It will take care of itself with growth in the economy.

· Money printing and quantitative easing is perfectly fine so long as the velocity of money remains low and the printing is nothing more than balances being shifted within Primary Dealer accounts.

· Transfer programs such as Social Security and Medicare are fully-funded and will always be there to provide a safety net for the elderly, the poor and the disabled. We have unlimited money to spend. If not enough, we have the printing press. You will retire comfortably!

· Ben Bernanke is an Einstein-level genius. We are very fortunate to have him as Fed Chairman at this critical point in history.

· Silver is simply an industrial metal. Always has been, always will be. Although it was used as money for centuries but it is outdated. We have now the printing press.

· As a by product of mining for other base metals, the amount of silver is infinite.

· Those hoarding silver are mindless robots, fooled by internet charlatans.

· Those brainless, Austrain economists are totally wrong. Reducing deficit and austerity will end in a depression.

· GLD is 100% backed by gold and it's custodian has no conflicts of interest.

· SLV is 100% backed by silver and it's custodian has no conflicts of interest.

· Mining stocks, in general, have been in a bear market since 2009 because the fundamentals are lousy.

· The LBMA is a distinguished group of member firms, which actively promote fair and free pricing of metal.

· JPMorgan is a benevolent organization which only performs necessary investment banking services for their clients.

· Goldman Sachs, Deutsche Bank, UBS, HSBC et al are similar, honest companies.

· High-frequency trading helps in price discovery and provides liquidity.

· The CME Group is a dispassionate facilitator of markets and clearing which stands ready to eliminate fraud and protect investors.

· The CFTC is an objective and honest U.S. government agency which regulates the futures markets, always on the lookout for fraud and manipulation so that the regular investor and/or hedger can have confidence in a fair and level playing field.

Any intelligent thinking person will know that most of the above is not true.

But the fundamentals can lag behind the price for a while. It has been said that the market can remains longer than you are solvent.

I do not think I will be wrong.

I do not think I will be wrong.

Strategies

Technically the trend is down. I will aggressively accumulate only when there is a change of trend. Make sure I have enough dry powder to accumulate. A number of indicators for a reversal are:

- Gold has consecutive close above 1680 to 1700

- Silver is above 32.5 and maintain there.

- Market demonstrating a change of sentiments and shorts and awaken to the precious metal fundamentals verified by technical indicators and price patterns

- I continue to accumulate physical metals through buying the metals itself and cautiously increase my positions on PSLV, and CEF which are my proxies for physical gold. These are funds sold by Sprout management.

- I still maintain a base portfolio of gold and gold mining stocks. These are stocks with impeccable fundamentals, good dividends, good cash flow and potentials for 2-3 X gain when gold reverses. However, they are all collared or covered with ITM covered call. Upon a change of trend I will remove the hedges. Meanwhile, do not fight against the trend. Overall, I still lose some money but am confident that I will gain it back once the trend reverses

Subscribe to:

Posts (Atom)